I’ve been looking at some Malaysian stocks recently, following IB’s decision to make this market available on their platform. Overall, my impression is that the Malaysian market doesn’t offer a lot of good opportunities currently.

I also saw some signs that shareholders are generally not treated that well by company management in Malaysian companies. It seems that shareholders are generally an afterthought for these companies, even more so than in Singapore and Japan. Minority shareholders generally keep quiet and seem to have a “management knows best” attitude and go along with whatever is proposed and decided by them.

As an example, I’ve seen several companies with a large excess cash balance where shareholders asked zero questions about returning cash to shareholders but did ask management to please consider handing out some vouchers before the next annual meeting so that shareholders could get a free lunch next time. I think that illustrates how shareholders see themselves and how they are generally treated by management.

The list of Malaysian companies I would ever consider investing in is very short. If I had to choose between Japan, Singapore and Malaysia, I think Japan is probably the most attractive of the three currently – in terms of company valuations and focus on shareholder value – followed by Singapore. I’d put Malaysia in last place.

That said, there are usually some things around that simply look so cheap by the numbers that I’m tempted to buy a small position in a few things anyway. 🙂 That was the case in Malaysia as well. The rest of this post is about one of these companies, Dancomech Holdings (5276.KL).

Here’s some summary financial information about Dancomech:

Share price: RM0.425 MYR (RM = Malaysian Ringgit)

Outstanding shares: 442.55m

Market cap: RM188.1m (~$44.2m USD)

Cash & short-term investments: 115m

Debt: 10.9m

Book value: 226.5m

Net income 2024: 23.2m

Net income 2023: 21.0m

P/BV: 0.83x

Trailing P/E: 8.1x

Business description

Dancomech’s two main segments are:

- Trading: trading and distribution of process control equipment (such as valves, switches, actuators, bursting discs/explosion protection devices, expansion joints, float/steam traps, etc.), measurement instruments (such as gauges, recorders, pressure transmitters, sight glasses, etc.), and industrial pumps

- Metal Stamping Division: comprises their 70% owned subsidiary MTL Engineering. Active in the production of metal stamping parts and components, and design and manufacture of tools and dies. This segment mainly services manufacturers of heating, ventilation and air-conditioning (HVAC) products, and manufacturers of metal furniture.

There are also three smaller segments that don’t look material to me at this point in time:

- Pump manufacturing

- Provision of material handling system solutions

- Electrical, electronic and instrumentation engineering, contracting, commissioning and servicing (E&E Engineering)

Dancomech mainly supplies to customers in the palm oil and oleochemicals, oil and gas, water and waste water, and HVAC industries. In terms of geographies, 85% of the company’s revenue comes from customers in Malaysia, 8% in Indonesia and 7% in other countries.

Historical financials

From glancing at the summary financial information above, the attraction of Dancomech is obvious. The company is quite cheap on an earnings basis, and there’s a very large excess cash balance as well. Dancomech’s enterprise value is only around RM84m currently.

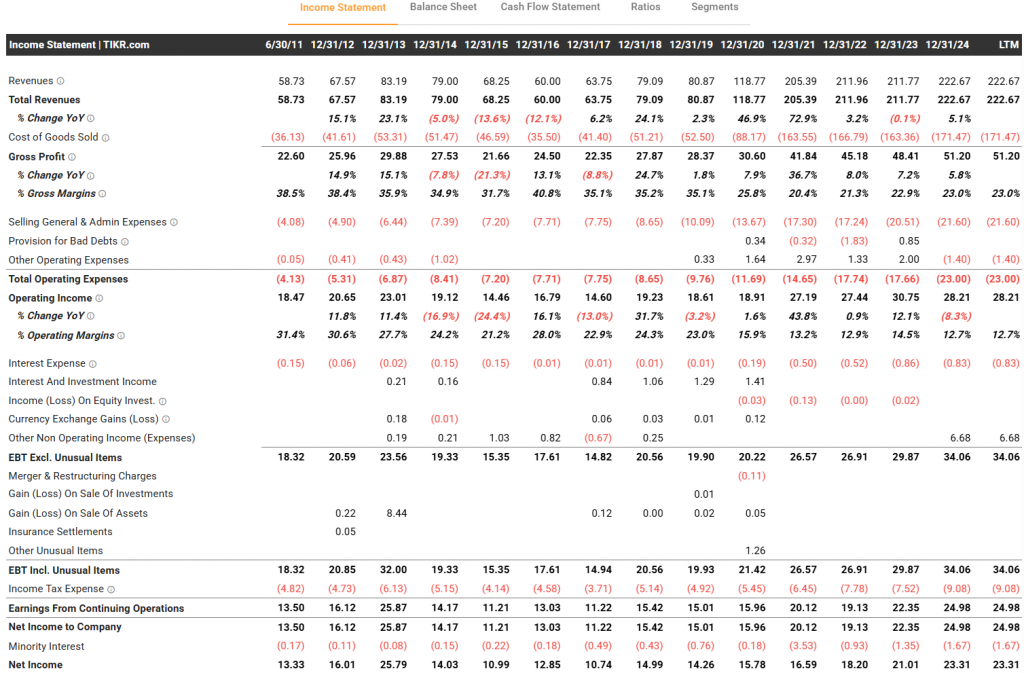

The company has a long history of consistent profitability and revenue growth as well:

Financials from TIKR.com

The company has made a few acquisitions along the way, so the revenue growth is not purely organic. Even though the financials shown above go back further, Dancomech has only been a publicly listed company since 2016, when it listed on Bursa Malaysia.

Insider Ownership

Aik Swee Tong is the managing director of the company and his brother, Aik Cwo Shing, is an executive director. Between them they own around 172m shares or 38.9% of the outstanding shares. A couple of other family members own small stakes as well.

Capital Allocation

There are many more listed companies with very large cash balances in Malaysia. The very depressed valuations of these companies in the market tells you something about what the market expects to happen with that cash balance: not much, or at least not much positive. What I’m looking for in companies like this is some indications that the market might be a bit too pessimistic about a particular company. I think that could be the case with Dancomech.

While it is true that the company has a lot of excess cash, I do think that management is looking to use the cash in a productive way and not squander it. I don’t think Dancomech is as bad as some of the true cash hoarders out there.

I have a few reasons for coming to that conclusion. The first is that the company’s existence on the stock market is still relatively short. The IPO was in July, 2016. The company doesn’t have super long track record of hoarding extreme amounts of cash.

More importantly, in 2020 the company made an acquisition of 70% of MTL Engineering (MTL). The purchase price was 23.8m, which is a meaningful amount for this company. The purchase included a cash balance of 6.9m, so the net cash outflow for the acquisition was 16.9m. As noted above, MTL comprises the company’s Metal Stamping segment. The acquisition seems to have worked out reasonably: I think the profit for MTL was 2.92m in 2024 and 3.13m in 2023. The disclosure for the results of the subsidiaries can be found on page 84-87 in the 2024 annual report. I took the profit for MTL (“MTLSB”), disclosed on pages 86 and 87, and subtracted the portion allocated to the non-controlling interest, disclosed on pages 85 and 86. There are also segment profit numbers on page 109, but I think those numbers include the minority interest and there might be some other charges excluded in that number as well.

The final reason why I think Dancomech is perhaps judged too harshly by the market is that it pays a reasonable dividend. The company has a dividend policy of paying 40% of its net income as a dividend each year. In recent years, the company has modestly exceeded this target. Dancomech’s dividend yield is currently 5.9%, which is pretty decent. If the company can create some value by making a few bolt-on acquisitions over time and the market recognizes this a bit more, this could lead to a solid return for investors.

Bonus Warrants

The company issued a bonus warrant to shareholders in 2017. In total 149m warrants were issued to shareholders in 2017 with an exercise price of RM0.30 and an exercise period of 5 years. The vast majority of these warrants were exercised during 2022. There are no warrants outstanding at this point.

I think it was a bit strange to issue these bonus warrants. I’ve seen this at a number of other Malaysian small caps. Executives seem to like issuing these to shareholders as a “reward”, but if there’s no real need for the capital, it doesn’t make much sense to me. It’s also fairly common for them to invest the company’s cash in other publicly traded companies. These things are unusual in most other international markets.

Anyway, normally a large stock issue is something that could be a red flag. In this case, the large stock issuance in 2022 reflects the exercise of the warrants. I don’t think this is a red flag, unless it is difficult for minority shareholders to exercise their warrants. Then the warrant issue could provide a way for management to increase their ownership at the expense of minority shareholders. I assume my broker will allow me to exercise any warrants that are issued in the future, but I’m not betting big on this company anyway.

Overdue Receivables

One trend I didn’t like was the increasing amount of receivables that was past due for more than 90 days. These increased from 6.5m (gross amount) in 2022 to 10.9m in 2023 (AR 2023, pages 93-94). This was a very large number considering the total amount of receivables was just 49.7m in 2023. So around 22% was overdue more than 90 days at that point.

The numbers for 2024 look improved: 4.7m was overdue more than 90 days on total receivables of 54.0m, or 8.7% of the total (AR 2024, page 93). But the company also mentions on the same page that it has relaxed its payment terms from 120 days to 150 days!

Now, even taking these loosened terms into account, the overdue receivables have improved. But the receivables balance at Dancomech and its quality are clearly items that need to be closely monitored by investors in future years.

The total amount of receivables has been pretty stable since 2021. The company’s cash generation has been strong as well.

Conclusion

I think Dancomech is a nice addition to a basket of cash-rich small caps that I like to keep in my portfolio. These positions are kept small and I don’t expect miracles from them. As a group, they tend to do pretty well. Dancomech pays a good dividend and management has made a reasonable acquisition just a few years ago. They are looking at other acquisition opportunities. The main negative is the quality of the receivables balance.

Overall I think the company’s valuation is too depressed currently. The company’s earnings have been quite consistent. The market price implies a huge haircut of the company’s cash balance is appropriate but I think that’s a bit too harsh in this case.

Disclosure: long Dancomech (5276.KL)

Disclaimer: This website is an investment journal of an individual, non-professional investor. It should be read as such.

None of the information presented on this website should be viewed as, or is intended to be, investment advice or a recommendation to buy or sell stock or any other security.

Just found this blog while looking into my concerns of the majority ownership of Brook Crompton. Great blog! Thanks for the great writeups!